The

Power to Pay

Pay when you want. Pay where you want. We’ve got your back.

Payments

Buy airtime, pay your bills, send money, shop online, and buy goods. Seamlessly manage all of your expenses and we will slowly recover from your future earnings.

Cashflow

Link your bank account or mobile money statements, input your expenses, and we provide the tools to cash out or spend as you earn, within your limits.

Cash Out

Link your mobile money or bank account and instantly cash out money you have earned but have not yet been paid.

Spend Responsibly

We provide tools to help you spend within your means by providing insights, guidance, and limits.

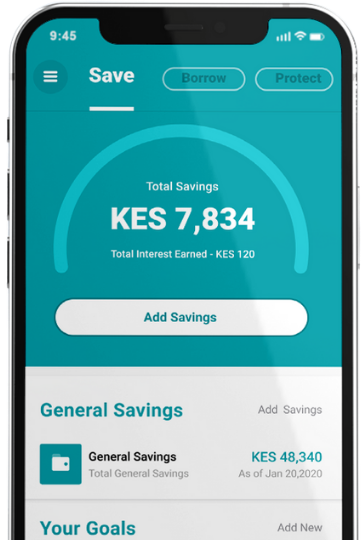

The

Power to Save

Save conveniently. Build your future.

Secure

Our licensed partners ensure that your savings are protected. Power just helps to streamline your contributions from your earnings!

Goal Savings

You have the power to set goals, allocate funds to these goals easily with scheduled deposits from your debit card, bank account, or via mobile money.

Flexibility

You get to choose where to put your savings! Power offers access to several savings accounts in Kenya, investment accounts, or your preferred wallet provider.

Investing in the Future

Leveraging on savings over time will eventually help secure you against those unexpected moments in life.

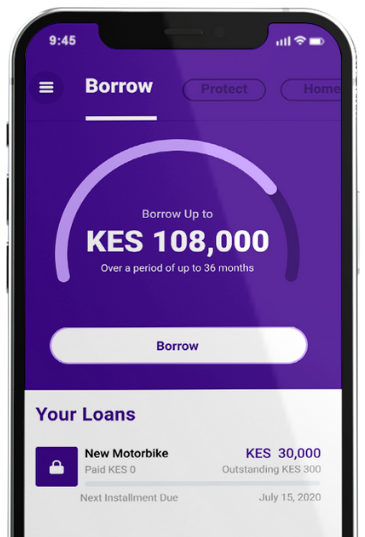

The

Power to Borrow

Customised loans that fit your life and help you grow.

Loans

Access to loans allows you to grow your assets. With Power, you get a unique amount, tenor, and interest rate based on the Power score.

Credit Profile

You impact your rates on loans! As you continue to use our platform, we will provide better offers based on your repayments, usage, and savings history.

Direct Debit

We will link to your income source so you don't have to worry about when to repay or how to repay!

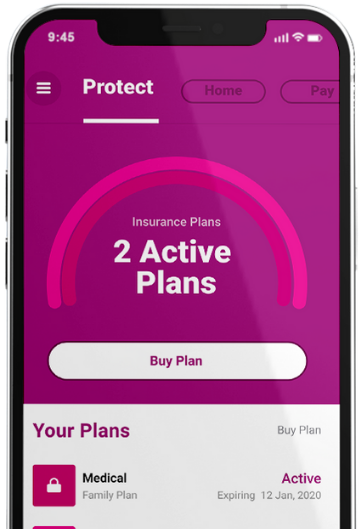

The

Power to Protect

Seamlessly cover the premiums from your earnings.

Buy Insurance Instantly

Instantly enroll in insurance provided by our insurance partners. We help with the premium financing and will make sure you have instant access while paying affordable monthly installments from your earnings.

Access to Information

Find out more about the details of your plans, make claims, and get responsive customer service through our insurance partners!